Debit Cards vs. Credit Cards: The Key Differences

Debit means balance, credit means debt. That part's clear. But with so many options like Maestro, MasterCard, V PAY, Visa Electron, Visa, AmEx, PostePay and more, it’s easy to lose sight. What are the actual differences? And which cards are essential in your checkout? Find out in this blog post.

Providing a Payment Service

A debit card is often referred to as a bank card in the Netherlands. It allows consumers to pay directly from their current account. Internationally, however, "debit card" often refers to what we would call prepaid cards – cards you top up in advance, where the spending limit equals the balance. What you see, is what you get.

Credit cards, unlike debit cards, typically come with additional services. Credit card providers like Visa, MasterCard, and American Express offer their own cards and payment services. Confusingly, they can also provide payment services to other card brands. For example, the popular Italian payment method Nexi works through Visa and MasterCard schemes. This allows Nexi to benefit from their global network, services, and guarantees – but with a local Italian twist.

The Difference Between Credit and Debit Cards

Both cards enable secure 3D-secure transactions for consumers and businesses. The key difference lies in reach. Debit cards are often limited to European countries within the Eurozone, while credit cards are accepted worldwide. That’s why shopping with a debit card in a foreign webshop can be tricky. Credit cards also offer extra services like purchase protection and pre-financing. But those services come at a cost — for both buyer and merchant.

Credit Cards

- Accepted worldwide

- Available for foreign online purchases

- Buy now, pay later (monthly or instalments)

- Purchase protection, discounts, and extras

- May incur extra fees for users

- Suitable for business payments (B2B)

- Secure with 3D Secure technology

Debit Cards

- Internationally accepted, but often limited to Europe

- Often not usable for foreign online purchases

- Direct payment from bank account or balance

- No additional services included

- No extra charges for Euro payments within Eurozone

- Secure with 3D Secure technology

Debit Cards Will Soon Be Used Globally

Debit card usage is currently limited. In countries like Italy and Spain, it works, but outside Europe it often doesn’t. That’s why you’ll soon see less of V PAY and Maestro. Your current Dutch debit card likely shows a Maestro logo — that’s being replaced by a MasterCard logo, allowing for worldwide use. Visa Debit is expected to replace V PAY, and Dutch banks are starting to issue Visa Debit as a replacement for Maestro.

What About the Costs?

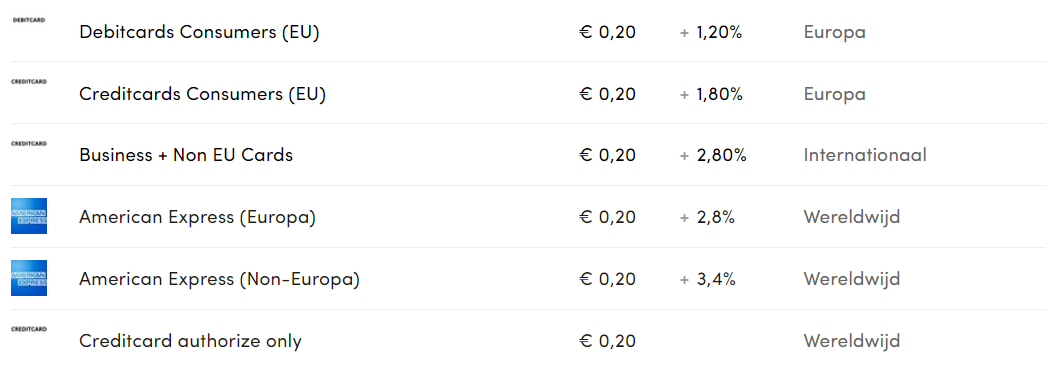

At Buckaroo, every credit or debit payment via MasterCard, Visa, AmEx or local cards that use these schemes is charged a fixed fee of €0.20 per online transaction, plus a variable rate (see image).

The percentage you pay as a merchant depends on:

- The type of card (business or consumer)

- Origin of the transaction (EU or non-EU)

- Card type (debit or credit)

Why are some card payments more expensive? It comes down to risk. Non-EU payments carry more risk. Debit transactions (balance) are less risky than credit ones, where the issuer fronts the money.

3D Secure: Safe Card Payments

iDEAL is the preferred method in the Netherlands because transactions are guaranteed. But abroad, iDEAL won’t get you far. Cards are essential for reaching international customers. But cards are more susceptible to fraud than iDEAL. A credit card number, expiry date, and CVV are easy to steal. That’s why 2-step verification — called Strong Customer Authentication (SCA) or 3D Secure — is mandatory. Every card transaction must be verified with a code or biometric check. This is already standard across Europe, with some exceptions for recurring payments.

Which to Choose: Debit or Credit?

At first glance, credit cards offer more benefits: wider reach and extra services. But you’ll need to pass a credit check to qualify. Debit cards are easier to obtain and come with lower annual fees and no interest. With global acceptance on the horizon, debit cards are becoming a strong alternative.

For merchants, debit card payments are also cheaper. Payment methods like iDEAL or Bancontact have lower transaction fees than credit cards, which charge a percentage. Plus, debit payments are final — no chargebacks. But if you serve international customers, offer high-value products, or operate in high-risk industries, credit cards are essential in your checkout.

Create a Payment Mix

Build a mix of debit and credit payment options. Tailor it to your audience and country. If you run a .com site or a single webshop, consider a dynamic checkout that adapts the payment methods based on your customer’s IP address.